Is it illegal to work remotely in another country?

Summary

Contents

- 1 Summary

- 2 Working Remotely in Another Country

- 3 Key Points

- 4 1. Notifying Your Employer

- 5 2. Tourist Visas

- 6 3. Compliance with Local Labor Laws

- 7 4. Tax Obligations

- 8 5. Employer Classification

- 9 Questions and Answers

- 9.1 1. Will my company know if I work from another country?

- 9.2 2. Can I live in Mexico and work remotely for a US company?

- 9.3 3. Is it illegal to work in the US and live in another country?

- 9.4 4. Can a US citizen work remotely in the UK?

- 9.5 5. Do I have to pay taxes if I work remotely in another country?

- 9.6 6. Is it illegal to work in another country without a visa?

- 9.7 7. Do you have to pay US taxes if you work in another country?

- 9.8 8. Can a US citizen work remotely abroad for a US company?

- 9.9 9. Where do I pay taxes if I work remotely?

Working Remotely in Another Country

Working remotely in another country has become increasingly popular in recent years, allowing individuals to have more flexibility and freedom in their work arrangements. However, there are several considerations and factors to keep in mind when it comes to the legality and practicality of working remotely in a different country.

Key Points

1. Notifying Your Employer

One important aspect of working remotely in another country is ensuring that you notify your employer or IT department about your location. This is necessary to prevent any confusion or security concerns, as your company needs to know where you will be logging in from.

2. Tourist Visas

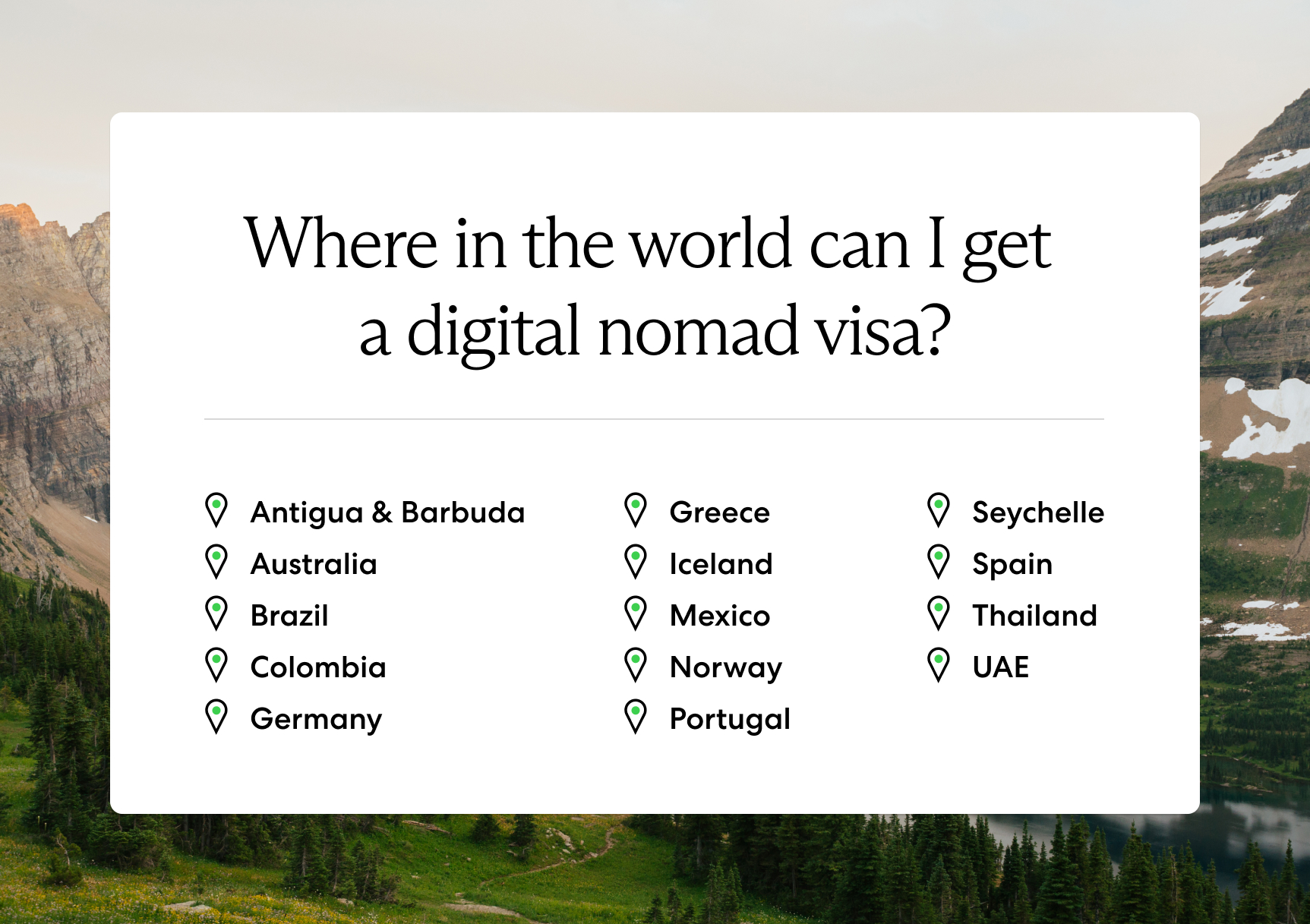

If you plan to work remotely in a country while on a tourist visa, it’s crucial to understand the regulations surrounding this. In some cases, it may be acceptable to work remotely for a foreign employer while on a tourist visa, but this varies depending on the country and its specific rules.

3. Compliance with Local Labor Laws

When working remotely in another country, it’s important to comply with the local labor laws and regulations. This includes understanding the need for work permits or visas, if required, and ensuring that you are abiding by any tax regulations in both your home country and the country you are working in.

4. Tax Obligations

Working remotely in another country may have implications for your tax obligations. Most countries have tax-residency rules that determine when you become a tax resident, and staying in a country for more than a certain period of time may require you to pay income tax there. It’s essential to familiarize yourself with the tax laws of both your home country and the country you will be working in.

5. Employer Classification

Whether you are classified as an independent contractor or an employee can impact your ability to work remotely in another country. Independent contractors generally have more freedom in choosing where they work, while employees may need to seek permission from their employer and follow local labor laws and regulations.

Questions and Answers

1. Will my company know if I work from another country?

You need to notify your employer or IT department about your location to avoid any misunderstandings or security issues.

2. Can I live in Mexico and work remotely for a US company?

While working remotely for a foreign employer on a tourist visa is generally accepted, it’s important to understand the specific regulations and limitations in each country. In Mexico, for example, you can work remotely on a tourist visa for up to 180 days.

3. Is it illegal to work in the US and live in another country?

As a US citizen, you can work for a US company and live abroad as long as you comply with local visa regulations. You will still need to pay taxes in the US as usual.

4. Can a US citizen work remotely in the UK?

Working remotely in the UK on a tourist visa is generally possible, but there may be other longer-term visa options available depending on your circumstances, such as the Youth Mobility Scheme Visa or the High Potential Individual Visa.

5. Do I have to pay taxes if I work remotely in another country?

Most countries have tax-residency rules, and if you stay in a country for more than a certain period of time, you may be considered a tax resident and required to pay taxes on your worldwide income. It’s important to be aware of the tax regulations in both your home country and the country you are working in.

6. Is it illegal to work in another country without a visa?

The legality of working in another country without a visa varies depending on the individual country’s regulations. Some countries may allow limited work activities on a tourist visa, while others have stricter rules in place.

7. Do you have to pay US taxes if you work in another country?

If you are a US citizen or resident alien living outside the United States, your worldwide income is subject to US income tax, regardless of where you live. You will need to file a US tax return and comply with US tax laws.

8. Can a US citizen work remotely abroad for a US company?

If you are classified as an independent contractor, you have more flexibility in choosing where you work. However, if you are classified as an employee, you may need to seek permission from your employer and comply with local labor laws and regulations.

9. Where do I pay taxes if I work remotely?

Remote workers may have tax obligations in both their home country and the country they are working in. It’s important to understand and comply with the tax regulations of both jurisdictions, including federal and regional taxes.

Will my company know if I work from another country

You would have to notify your employer or at least your IT department especially if you will be working in a different country. IT has to ensure they know where you will be logging in from so they do not mistake you for an intruder and lock you out. Again this might be a bit different in each company.

Can I live in Mexico and work remotely for a US company

Tourist Visa

As a tourist, you are generally not allowed to work for Mexican employers or earn income within Mexico. However, working remotely for a foreign employer while on a tourist visa is generally accepted. Visitors are allowed up to 180 days on a tourist visa.

Is it illegal to work in the US and live in another country

As a US citizen, you can work for a US company and live abroad so long as you comply with local visa regulations. An American citizen will continue to pay taxes in the US as usual. For US citizens, as long as you are in good standing with your employer, remote work from abroad should be possible.

Cached

Can a US citizen work remotely in the UK

However, the UK does offer a generous six-month tourist visa, and working remotely on a tourist visa UK is possible. There are also several longer-term visas available that many digital nomads may qualify for, such as the Youth Mobility Scheme Visa and the High Potential Individual Visa.

Can a US citizen working for a US company work remotely in another country

If you're classified as an independent contractor, then you're free to choose where you work. However, if you're classified as an employee, you'll have to ask your employer for permission to work remotely. In both cases, you'll need to abide by local labor laws and check if you require a work permit.

Do I have to pay taxes if I work remotely in another country

Do You Have to Pay Remote Work Taxes in Another Country Yes. Most countries have tax-residency rules that dictate how long you can stay in their country before becoming a tax resident. In most cases, you must file as a tax resident and pay income tax if you stay for more than six consecutive months in a year.

Can I move to Mexico and work if I’m American

Moving to Mexico to Work

You can move to Mexico for work if you have been offered a job by an employer in Mexico. However, your employer must apply for you since you cannot apply directly for a work visa yourself.

Do I have to pay taxes if I work remotely in Mexico

Do Digital Nomads Pay Taxes in Mexico Digital nomads working in Mexico will need to comply with the country's tax regulations. If you stay in Mexico for more than 183 days within a calendar year, you may be considered a tax resident. Therefore, you'll be required to pay taxes on your worldwide income.

Is it illegal to work in another country without a visa

There's no universal visa rule for every country in the world. Some countries might allow you to work on a tourist visa if the scope of your work is limited to your country of residence, for example, while others might take a harsher approach, even if you're not interacting with the local workforce.

Do you have to pay US taxes if you work in another country

1. I'm a U.S. citizen living and working outside of the United States for many years. Do I still need to file a U.S. tax return Yes, if you are a U.S. citizen or a resident alien living outside the United States, your worldwide income is subject to U.S. income tax, regardless of where you live.

Can a US citizen work remotely abroad for a US company

If you're classified as an independent contractor, then you're free to choose where you work. However, if you're classified as an employee, you'll have to ask your employer for permission to work remotely. In both cases, you'll need to abide by local labor laws and check if you require a work permit.

Where do I pay taxes if I work remotely

Remote workers have to pay two types of taxes: federal (or national) and regional. The federal (national) taxes are those paid to the overall government, while the regional taxes are paid at a state, local, or provincial level. Those taxes will often apply to wherever you receive an income.

How is working remotely abroad for a US company taxed

The income is taxed in the US when it is earned within the country. Hence, taxes are paid in the state where the work is performed. If you work remotely, from another country, your income isn't US-sourced, thus, isn't taxed in the US.

How long can a US employee work abroad without tax implications

183 days

The 183 day rule

The standard global threshold of tax credit for an individual to live tax-free in a foreign country during one financial year is 183 days.

Can a US citizen working for a US company work remotely in another country without any tax implications in the new country

Unless you completely give up your U.S. citizenship, you're going to have to pay U.S. taxes. But check with a tax professional on ways to reduce what you have to pay.

How long can a US citizen stay out of the country

You can travel abroad for as long as you'd like without any risk of losing your U.S. citizenship. And if you plan to stay outside of the United States for longer than a year, you won't need a re-entry permit in order to return, as is the case for green card holders (permanent residents).

How long can a US citizen live in Mexico

Once you arrive in Mexico, you must present the visa to the National Migration Institute (INM) to receive a temporary resident card. This card will allow you to stay in Mexico for four years.

How long can you work remotely in another country without paying taxes

183 days

For example, if you spend more than 183 days outside of your home location, some countries see you as a taxable resident and require you to pay tax for any local economic activity.

Do I have to pay taxes to the US if I work in another country

Do I still need to file a U.S. tax return Yes, if you are a U.S. citizen or a resident alien living outside the United States, your worldwide income is subject to U.S. income tax, regardless of where you live.

What happens if you get caught working without a work visa

Deportation. Engaging in unauthorized work or breaching the conditions of your visa could lead to removal proceedings and deportation from the U.S. Deportation can have long-lasting effects on your ability to apply for other immigration benefits in the future.

Can I live in Europe and work remotely for a US company

Yes, a US citizen can work for a US company while living in Europe. However, there are a few things to keep in mind. While there are no legal barriers to working for a US company while living in Europe, several practical considerations need to be taken into account.

How does IRS know about foreign income

US taxpayers are required to report their worldwide income and foreign financial assets annually on their tax returns and on international informational reports, such as FinCEN Form 114 (FBAR), Form 8938, etc.

How long can I work outside the US without tax implications

183 days

The 183 Day Rule

The most general rule is the 183 Day Rule. As per this Rule, if the employee is residing in a country for a period of more than 183 days in one financial year, then they will be considered a resident of that country for tax purposes.

Do I get double taxed if I work remotely

Can a remote worker be taxed twice on income Yes, if the remote employee/contractor is in the US and works for an employer based in a convenience rule state.

Can I claim my home office on my taxes if I work remotely

Rather, you need to be classified as self-employed. And this is where a number of people risk making a mistake on their tax returns. Even if you work from home 100% of the time, if you're on a company's payroll, it means you aren't eligible to claim a home office deduction.