How do I remove a card from my American Express Online Service?

Summary

In this article, we will discuss the process of removing cards from various American Express services and answer some common questions related to card removal.

Main Thought

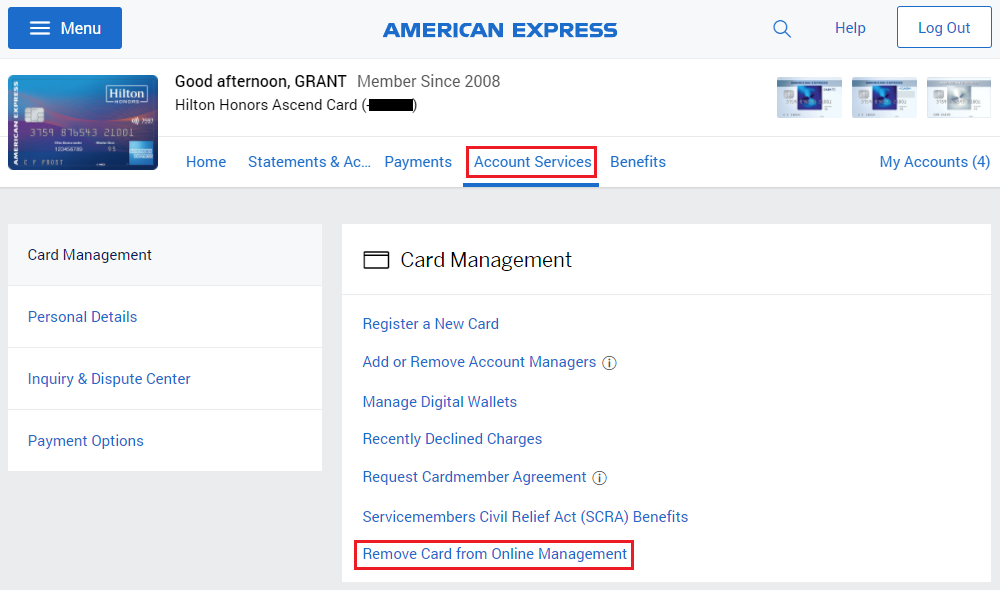

Removing a card from American Express Online Services is a straightforward process. Simply visit the Manage Accounts tab, go to Card Management, and click the option to Remove a Card from Online Services.

Main Thought

If you need to remove an additional cardholder from your Amex account, you can do so by calling customer service at their dedicated number, 800-528-4800.

Key Points

1. To close an American Express credit card, you have two options: contact customer care or send a letter to the head branch. Make sure to pay off any outstanding balances before closing the account.

2. If you want to remove your bank account from Amex, you can do it online by selecting the Settings option. Then, go to Bank Accounts under Bank & Payment Accounts, select the desired bank account number, and click the trash can icon to confirm.

3. If you want to remove a payment method from your American Express card, sign in to your account and navigate to the payment methods section. Underneath the desired payment method, click on the remove option and confirm your decision.

4. Canceling a credit card can have an impact on your credit score, so it’s important to consider the decision carefully. Pay off all balances and cancel any recurring payments associated with the card before closing it.

5. To remove an authorized cardholder, call the number on the back of your credit card and request the removal of the authorized user. Some credit card issuers may also allow you to remove an authorized user online or through their mobile app.

Questions and Answers

1. Question: How do I remove a card from American Express Online?

2. Question: How do I remove an additional cardholder from Amex?

3. Question: How do I cancel one of my American Express cards?

4. Question: How do I remove my bank account from Amex?

5. Question: How do I remove a payment method from my card?

6. Question: Does canceling a credit card hurt your credit?

7. Question: How do I remove an authorized cardholder?

8. Question: How do I remove an extra credit card?

9. Question: Does canceling an Amex card hurt your credit?

10. Question: Does canceling Amex affect credit?

11. Question: How do you unlink bank accounts?

12. Question: How do I delete a serve card?

13. Question: How do I remove a card from payment and shipping in settings?

14. Question: Why can’t I remove a payment card on iPhone?

15. Question: Is it better to cancel unused credit cards or keep them?

Please note: The article contains images and example code for better understanding, but due to the limitations of the text format, they cannot be displayed here.

How do I remove a card from American Express Online

To remove a Card(s) from Online Services, visit the Manage Accounts tab, go to Card Management and click Remove a Card from Online Services.

How do I remove an additional card holder from Amex

To remove an authorized user from your American Express account, call customer service at 800-528-4800.

Cached

How do I cancel one of my American Express cards

You can close your American Express credit cards through two ways; by contacting customer care or by dropping a letter to the head branch. You can close your card account or switch to a better option if you think you cannot make the most out of your current credit card.

How do I remove my bank account from Amex

Inactivate a bank accountSelect Settings.Select Bank Accounts under Bank & Payment Accounts.Select the bank account number.Select the trash can icon.Check the box and select Confirm.

How do I remove a payment method from my card

Page sign in if you're prompted. Once it loads up just tap on remove underneath the payment method you want to remove from your account and confirm your decision when it asks you to.

Does cancelling a credit card hurt your credit

Canceling a credit card can hurt your credit, so it's important to consider the decision carefully before you do so. Creating a well-thought plan will help you avoid or minimize changes to your score. If you decide to close the account, pay off all outstanding balances and cancel recurring payments.

How do I remove an authorized card holder

To remove an authorized user, call the number on the back of your credit card to reach the card issuer's customer service number and request the authorized user to be removed from the account. Some credit card issuers may even allow you to remove an authorized user online or via the company's mobile app.

How do I remove an extra credit card

In most cases, cardholders or authorized cardholders can call or email the card issuer to remove the authorization, but some banks require the request to be submitted in writing in order to be finalized. Authorized cardholders should then destroy their cards.

Does cancelling an Amex card hurt your credit

Length of your credit history may also be adversely affected by canceling a credit card because doing so can reduce your average account age and the overall length of your credit history. Credit scoring models consider longer credit histories more favorable than shorter ones.

Does cancelling Amex affect credit

Closing a credit card won't immediately affect your length of credit history (worth 15% of your FICO Score) by lowering your average credit age. Even after you close a positive account, it may remain on your credit for up to 10 years. But after that, it could decrease your score.

How do you unlink bank accounts

You can log in to online or mobile banking for one of the accounts you want to link. In the banking menu, you'll want to look for the option to link external accounts. You'll need to enter the routing number and account number to start the process.

How do I delete a serve card

Yes, you can cancel an American Express Serve card anytime. You can do that online by logging in to your account and selecting Main Account on the Home screen. Then, click or tap on the gear icon and select Close Account.

How do I remove a card from payment and shipping in settings

Open the Settings app. Tap your name. Tap Payment & Shipping. Tap Edit, tap the red Delete button, then tap Remove.

Why can’t I remove payment card on Iphone

If you have an unpaid balance, you may not be able to remove a payment method. Instead, change your payment method.

Is it better to cancel unused credit cards or keep them

In most situations, it's better to keep unused credit card accounts open, as closing credit accounts can have a negative impact on your credit score.

Is it better to cancel a credit card or let it expire

Canceling a credit card can shorten the average age of all accounts, which can negatively affect your score. If your score has already dropped due to other negative items, such as late payments or large debt balances, it's probably best to keep the account open instead of closing it.

Can I remove an authorized user from my credit card online

To remove an authorized user, call the number on the back of your credit card to reach the card issuer's customer service number and request the authorized user to be removed from the account. Some credit card issuers may even allow you to remove an authorized user online or via the company's mobile app.

Can I remove an authorized user online

Online. Go to the account management page. Find the section for authorized users, select the user you'd like to remove, and confirm removal. Most credit card issuers allow you to remove authorized users online.

Will canceling my extra card hurt my credit

It can raise your credit utilization ratio

Canceling a credit card can hurt your credit by increasing your credit utilization — the ratio of your outstanding credit balances divided by your total credit limit.

What happens if I have extra credit on my credit card

Overpaying your credit card will result in a negative balance, but it won't hurt your credit score—and the overpayment will be returned to you.

Is it better to cancel a credit card or just not use it

Impact on future credit opportunities

Canceling a credit card could impact your ability to get approved for future credit. Lenders look at your credit history and credit score to determine your creditworthiness. They also see your credit applications, and a history of canceling credit cards could be seen as a red flag.

Should I cancel a credit card I don’t use anymore

Canceling a credit card will cause a direct hit to your credit score, so more often than not, you'll want to keep the account open. Correctly managing an open, rarely-used account may require some extra attention, but the added effort will help your credit in the long run.

How do I unlink my bank account from any app

Log in to your chosen UPI app that you wish to unlink from your bank account. Locate the profile option on the home page and tap on it. Tap on the icon representing settings in the UPI app. Under settings, you will find the deregister option; click on it.

Can I remove someone from having access to my bank account

In most cases, yes. Many joint accounts require the consent of all account holders to remove someone from the account. This ensures fairness and security in shared financial arrangements.

Can I lock my American Express Serve card

And manage cards. Select freezer and freeze a card and here you see all the cards on your online account tap on the card you wish to freeze. And then select freeze.