Can I be refunded to my credit card?

Summary

Contents

- 1 Summary

- 2 Main Thought

- 3 Key Points

- 4 1. What happens when money gets refunded to my credit card?

- 5 2. Do refunds count towards credit card payment?

- 6 3. What happens if I have a negative balance on my credit card?

- 7 4. Can I transfer a credit card refund to my bank account?

- 8 5. What happens if I overpay my credit card?

- 9 6. Can a negative credit card balance be refunded?

- 10 7. What happens if you get a refund on a credit card with no balance?

- 11 8. What happens when you transfer money from a credit card to a debit card?

- 12 9. How do I request a refund of a credit balance?

- 13 10. Can I transfer a negative balance from a credit card?

- 14 11. What happens if I overpay my credit card balance?

- 15 Questions and Answers

- 15.1 1. Can I be refunded to my credit card?

- 15.2 2. Do refunds count towards credit card payment?

- 15.3 3. What happens if I have a negative balance on my credit card?

- 15.4 4. Can I transfer credit card refunds to my bank account?

- 15.5 5. What happens if I overpay my credit card balance?

- 15.6 6. Can a negative credit card balance be refunded?

- 15.7 7. What happens if you get a refund on a credit card with no balance?

This article discusses various aspects of credit card refunds, including what happens when money gets refunded to a credit card, whether refunds count towards credit card payments, and what happens if you have a negative balance on your credit card. It also explores the options for transferring credit card refunds to a bank account, the implications of overpaying a credit card balance, and the process of requesting a refund for a credit balance. Additionally, it addresses the possibility of transferring a negative credit card balance and whether credit card refunds can be reversed.

Main Thought

Credit card refunds are a common occurrence in financial transactions, and it’s important for consumers to understand how they work and the impact they have on their credit card accounts.

Key Points

1. What happens when money gets refunded to my credit card?

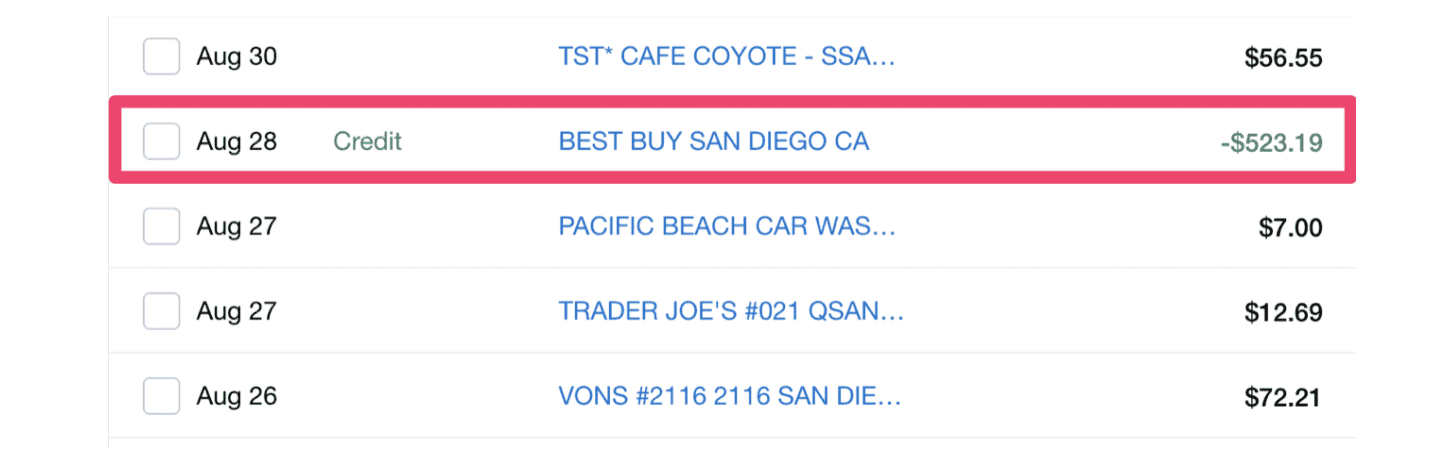

The merchant refunds the purchase amount back to your credit card issuer, and the card issuer then credits your account for the returned amount, removing it from your statement balance. Depending on the merchant’s return policy, you may have to meet certain requirements to get a refund.

2. Do refunds count towards credit card payment?

A credit card refund doesn’t count as a payment or partial payment. This means that it shouldn’t affect your credit score. Even if you go into a negative balance as a result of a late refund, this shouldn’t be reported to credit agencies. Getting a refund on a credit card should be a fairly simple process.

3. What happens if I have a negative balance on my credit card?

Ultimately, nothing really happens if you have a negative credit card balance. It doesn’t hurt you. But still, you want to check in on your account regularly to make sure you don’t wind up with a negative balance.

4. Can I transfer a credit card refund to my bank account?

Depending on your credit card’s issuer, credit balance refunds can be sent as a check or a refund to the bank account from which the payment was originally taken. You can usually contact your credit card issuer online, over the phone, or by mail to ask for a credit balance refund.

5. What happens if I overpay my credit card?

You won’t be penalized for overpaying your credit card, but there are also no benefits for doing so. When you pay more than the balance due, your issuer should automatically issue the amount you’re owed as a statement credit, and your credit line will reflect a negative balance until you’ve spent the credit.

6. Can a negative credit card balance be refunded?

A negative balance will usually sit in an account for at least 60 to 90 days before the bank may decide to refund the money via check or cash deposit into a linked account. Because the card issuer owes the cardholder, there won’t be a monthly payment required or danger of accruing interest.

7. What happens if you get a refund on a credit card with no balance?

However, if you’re already carrying a balance on your credit card when the refund posts, the good news is it will credit the account and reduce the total amount you owe for the next billing cycle. If you had a $0 balance, the credit will still be applied to your account and will show up as a negative balance.

8. What happens when you transfer money from a credit card to a debit card?

There is usually a fee to perform a transfer between a credit card and a debit card, and you need to be aware of what interest rate you will be paying on the transferred funds. Fees and charges may vary depending on your provider.

9. How do I request a refund of a credit balance?

To request a refund of a credit balance, send a written refund request to your bank or credit card company. Specify how you want the refund paid, such as cash, check, money order, or credited to a deposit account. The bank must refund the money within seven business days upon receiving the written request.

10. Can I transfer a negative balance from a credit card?

When you have a negative balance, you can request that the amount of that balance be deposited into your bank account. Alternatively, you can request a check, money order, or even cash in the amount of the negative balance. A negative balance is similar to a statement credit.

11. What happens if I overpay my credit card balance?

Whether you’ve made too large a payment or had a refund come through for a recent return, an overpayment results in a negative balance on your credit card. Your credit card issuer owes you money instead of the other way around.

Questions and Answers

1. Can I be refunded to my credit card?

Answer

2. Do refunds count towards credit card payment?

Answer

3. What happens if I have a negative balance on my credit card?

Answer

4. Can I transfer credit card refunds to my bank account?

Answer

5. What happens if I overpay my credit card balance?

Answer

6. Can a negative credit card balance be refunded?

Answer

7. What happens if you get a refund on a credit card with no balance?

Answer

Note: Please replace the “img” tags with the appropriate image URLs.

What happens when money gets refunded to my credit card

The merchant refunds the purchase amount back to your credit card issuer, and the card issuer then credits your account for the returned amount, removing it from your statement balance. Depending on the merchant's return policy, you may have to meet certain requirements to get a refund.

Cached

Do refunds count towards credit card payment

A credit card refund doesn't count as a payment or partial payment. This means that it shouldn't affect your credit score. Even if you go into a negative balance as a result of a late refund, this shouldn't be reported to credit agencies. Getting a refund on a credit card should be a fairly simple process.

What happens if I have a negative balance on my credit card

Ultimately, nothing really happens if you have a negative credit card balance. It doesn't hurt you. But still, you want to check in on your account regularly to make sure you don't wind up with a negative balance. Chase Sapphire is an official partner of the PGA Championship.

Can I transfer credit card refund to my bank account

Depending on your credit card's issuer, credit balance refunds can be sent as a check or a refund to the bank account from which the payment was originally taken. You can usually contact your credit card issuer online, over the phone or by mail to ask for a credit balance refund.

What happens if I overpay my credit card

You won't be penalized for overpaying your credit card, but there are also no benefits for doing so. When you pay more than the balance due, your issuer should automatically issue the amount you're owed as a statement credit and your credit line will reflect a negative balance until you've spent the credit.

Can a negative credit card balance be refunded

A negative balance will usually sit in an account for at least 60 to 90 days before the bank may decide to refund the money via check or cash deposit into a linked account. Because the card issuer owes the cardholder, there won't be a monthly payment required or danger of accruing interest.

What happens if you get a refund on a credit card with no balance

However, if you're already carrying a balance on your credit card when the refund posts, the good news is it will credit the account and reduce the total amount you owe for the next billing cycle. If you had a $0 balance, the credit will still be applied to your account and will show up as a negative balance.

What happens when you transfer money from credit card to debit card

Fees and charges

There is usually a fee to perform a transfer between a credit card and a debit card. This will depend on your provider but is usually somewhere between 1% and 5%. However, you need also to be aware of what interest rate you will be paying on your credit card on the funds you have transferred.

How do I request a refund of a credit balance

Send a written refund request to your bank or credit card company. Tell them how you want the refund paid (e.g., cash, check, money order, or credited to a deposit account). Once the written request is received, the bank must refund the money within seven business days.

Can I transfer negative balance from credit card

When you have a negative balance, you can request that the amount of that balance be deposited into your bank account. You can do this because a negative balance is similar to a statement credit. If you'd prefer, you can also request a check, money order, or even cash in the amount of the negative balance.

What happens if I overpay my credit card balance

Whether you've made too large a payment or had a refund come through for a recent return, an overpayment results in a negative balance on your credit card. Suddenly, your credit card issuer owes you money instead of the other way around.

Can credit card refund reversed

Once a refund has been made, it is permanent. The credit card or direct debit account will need to be charged again if the transaction was refunded by mistake. Re-processing the transaction will require the full credit card or account number.

Can I overpay my credit card to increase limit

An overpayment will not help boost your credit limit, not even temporarily. Your credit limit remains the same – you'll just have a negative balance that will be applied toward your next statement. Details like credit score and income are usually factored into a credit limit increase.

Can I transfer money from bank account to credit card

You can send a payment to your credit card at any time. If your credit card was issued by the same bank that holds your checking/savings account, you can probably do this from their website or phone app very much like making a balance transfer.

Is money transfer from credit card bad for credit score

Transferring a balance from one credit card to another can affect your score – but whether the effect is positive or negative depends on several factors. Here's how a balance transfer might lead to your score being lowered: Applying for any credit, including a balance transfer card, will temporarily reduce your score.

How long does it take to get a refund on a credit card

How Long Does a Credit Card Refund Take The credit card refund time can vary, depending on the merchant or service provider. Credit card refunds usually take up to 7-10 business days to reflect on your account. However, some merchants or issuers may process refunds more quickly, while others may take longer.

Can a transaction be refunded

A refund or a reversal can be initiated by either the client, the merchant or an issuing bank. However, refunds are usually actuated by the client if they discover that a product or service was unsatisfactory for whatever reason.

Can I dispute a charge that I willingly paid for

The short answer is yes, in some circumstances, you can dispute credit card charges you willingly made and paid for. This is in accordance with the Fair Credit Billing Act, which affords consumers some protections regarding their credit purchases.

What happens if I overpay credit card

Overpaying your credit card will result in a negative balance, but it won't hurt your credit score—and the overpayment will be returned to you.

What happens if I pay my credit card early

By making an early payment before your billing cycle ends, you can reduce the balance amount the card issuer reports to the credit bureaus. And that means your credit utilization will be lower as well, which can boost your credit scores.

What happens if you add money to your credit card

You don't add money to your credit card. You re-pay the money you borrowed (i.e. when you swipe your credit card making any purchases). Credit card is designed for you to borrow interest free if you pay up on the due date and pay huge interest if you don't pay on the due date.

Can I add money to my credit card to increase limit

No, limit can be increased by regular usage not by making extra payment. If you made extra payment in your credit card then there will be of no benefit of it. Extra payment will be adjusted in your upcoming payments. If you want to increase your limit then use your credit card as much as you can and pay it on time.

What happens if you transfer money to credit card

Most issuers charge a balance transfer fee of around 1% to 5% of the amount you transferred. The fee is usually added to your balance. So if the fee is 3% and you transferred $2,000, you'll be charged $60, bringing your total to $2,060.

Can you send money to a credit card

But that's exactly what you can now do. Rather than paying into someone's bank account, you can transfer money straight to their debit or credit card. It's that simple, and there are heaps of benefits to sending money this way.

Can a credit card payment be reversed

Payment reversal (also "credit card reversal or "reversal payment") is when the funds a cardholder used in a transaction are returned to the cardholder's bank. This can be initiated by the cardholder, merchant, issuing bank, acquiring bank, or card association.